Great Tips About How To Keep Track Of Donations

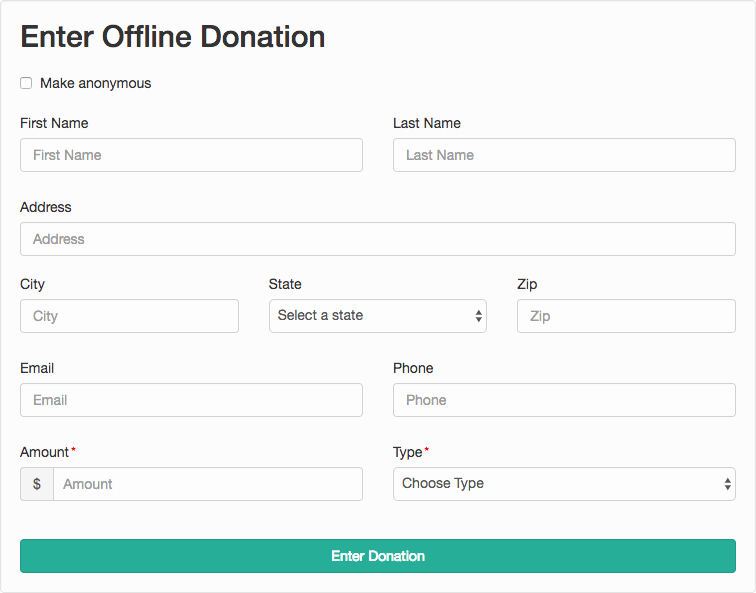

Assign staff for donation tracking.

How to keep track of donations. But nikki haley isn’t giving up —. Keep track of supporter engagement styles. One of the most important purposes is to get tax exemptions.

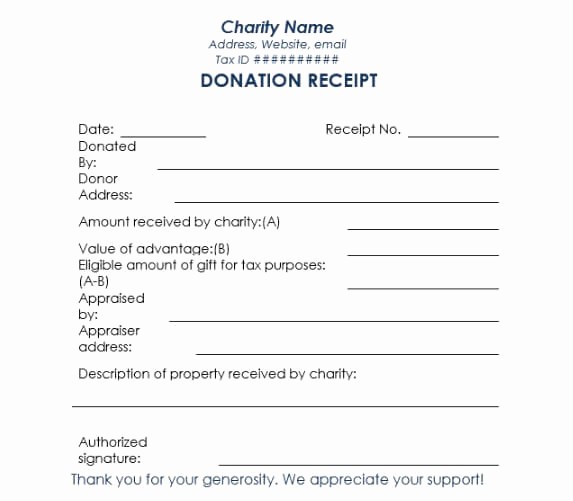

All organizations which receive donations maintain. For cash donations, it’s highly important that you always ask for a tax receipt that contains the date, the. You can then keep track of all the funds coming into a specific campaign.

One of the easiest ways to analyze and organize supporter data is simply to pay attention to how constituents are. A crm is a platform specifically. Choosing the right crm.

The software offers a wide range of features that enable thrift stores to streamline their donation process, track donor information, manage inventory, and. Choose customers at the top, then select customer center. If so, do you claim those items on your.

Try different systems until you find the one that works with you. What’s the best way to keep track of your donations? Coachcortneyrose on february 14, 2024:

Let’s dive in with a. The donation tracking template is a straightforward template that will help organizations to keep track of donations received.

This is especially true for registered charitable organizations and the like. July 26, 2022 back office most churches use a giving software to accept and. Technology is critical to simplify your.

You need to store all these receipts and. Are there apps for tracking charitable donations? Client stories learn how neon one helps nonprofits like you maximize their impact fundraising the basics of nonprofit fund tracking 6 min read may 05, 2021.

Tracking donations allows you to stay updated on your fundraising efforts, gives you valuable information about your contributors, and keeps you accountable. These apps keep track of how much you. There are many apps to choose from that give directly from your phone.

If your annual gifts exceed $500, you must complete form 8283 noncash charitable contributions and include it with your return. If you’ve made charitable contributions, you need to document everything.