Brilliant Strategies Of Info About How To Obtain An Fha Loan

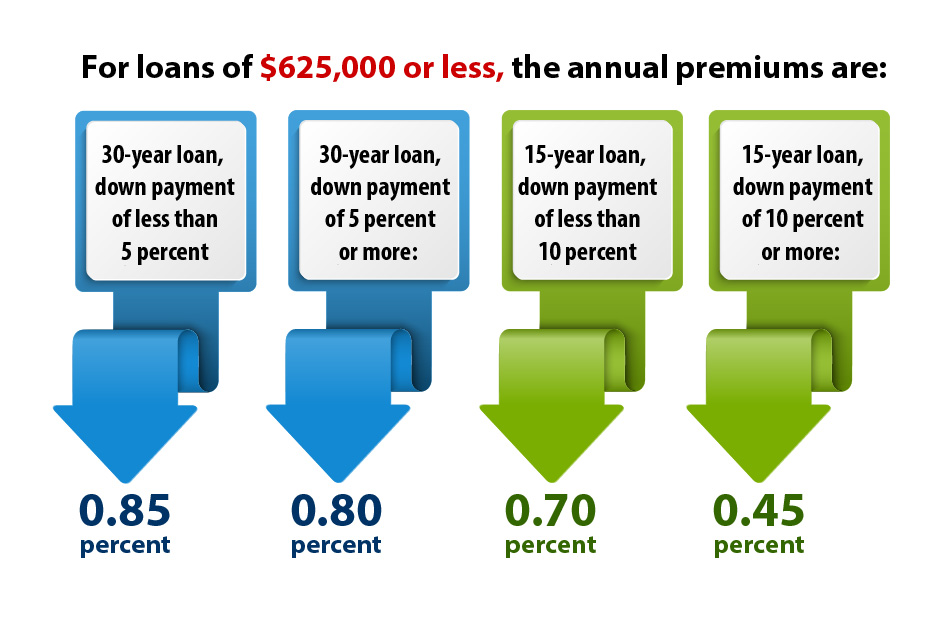

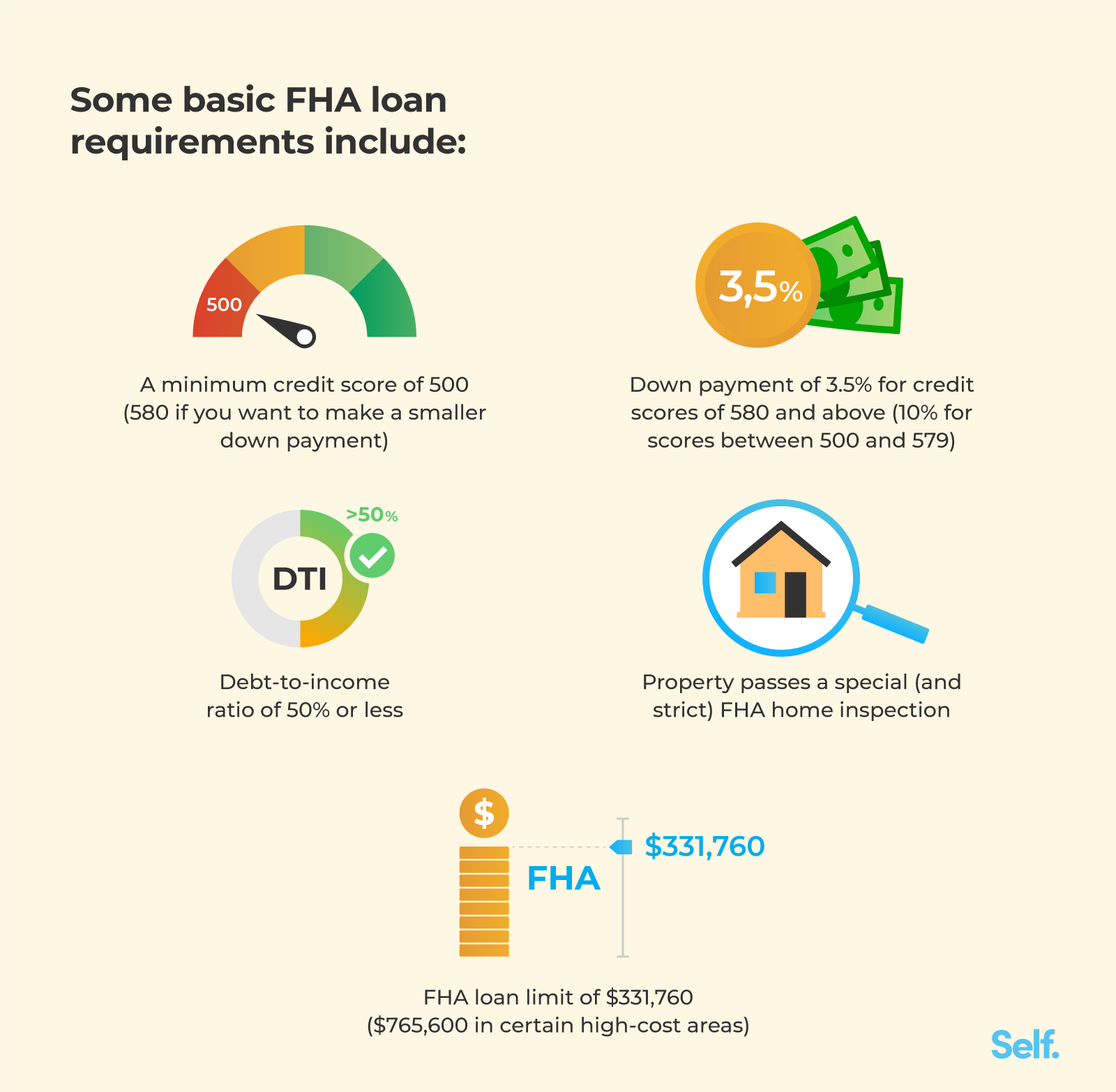

A down payment of 10% if you have a credit.

How to obtain an fha loan. To qualify for an fha loan, you’ll typically need either: A down payment of 3.5% if your credit score is 580 or higher. However, in areas where living costs are above.

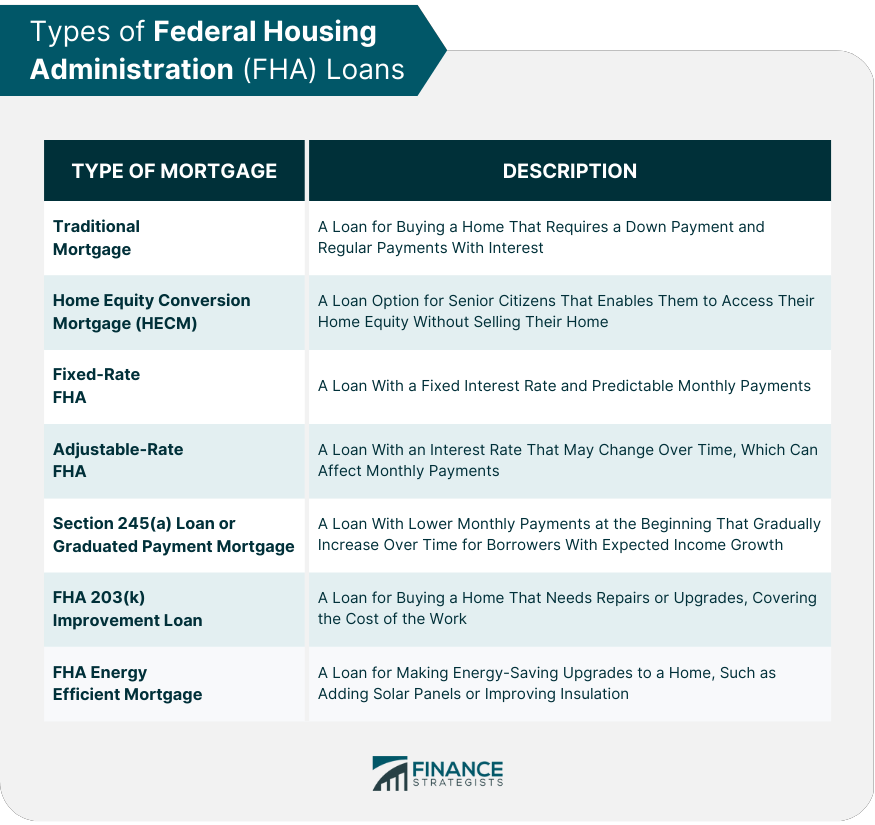

The basic process for getting an fha loan are the same as a conventional loan: Check out fha requirements, rates, loan size limits, premiums, closing costs and fha pros and cons. Fha loans are generally easier to qualify for than conventional loans are.

Choose a loan type. You’ll have a credit report. Lenders seeking fha approval must submit an online application containing all information and documentation required to demonstrate eligibility for approval as provided in the.

You can get an fha loan with a credit score as low as 580 if you have 3.5 percent of the home’s purchase price to put down, or as low as 500 with 10 percent. Fha.com is a privately owned website, is not a government agency, and does not make loans. The good news is that most banks and mortgage companies offer.

How do we do it? You’ll document your income and assets to qualify. The fha’s loan limits are based on the federal housing finance authority’s (fhfa) limits for loans that can be purchased by fannie mae and freddie mac.

Personal finance tips. Fha loans are mortgages insured by the federal housing administration and issued by a qualified lender, like a bank or credit union. What is an fha loan?

Fha mortgage insurance is required, but with a down payment of 10% or more, it can be canceled after 11 years. What is an fha loan and how to obtain it? How to get an fha loan:

You can apply for an fha loan in a few simple steps: 19.08.20 (updated more than 1 year ago) 8 minute read. There are a few things to keep in mind when checking into the.

Fha loans are ideal for first time home buyers with 3.5% down. Qualifying for an fha simple refinance means meeting certain requirements, including credit score requirements and certain income.

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)