Awesome Info About How To Get Out Of Fixed Loan

The quickest way to get rid of your car loan is to sell your car.

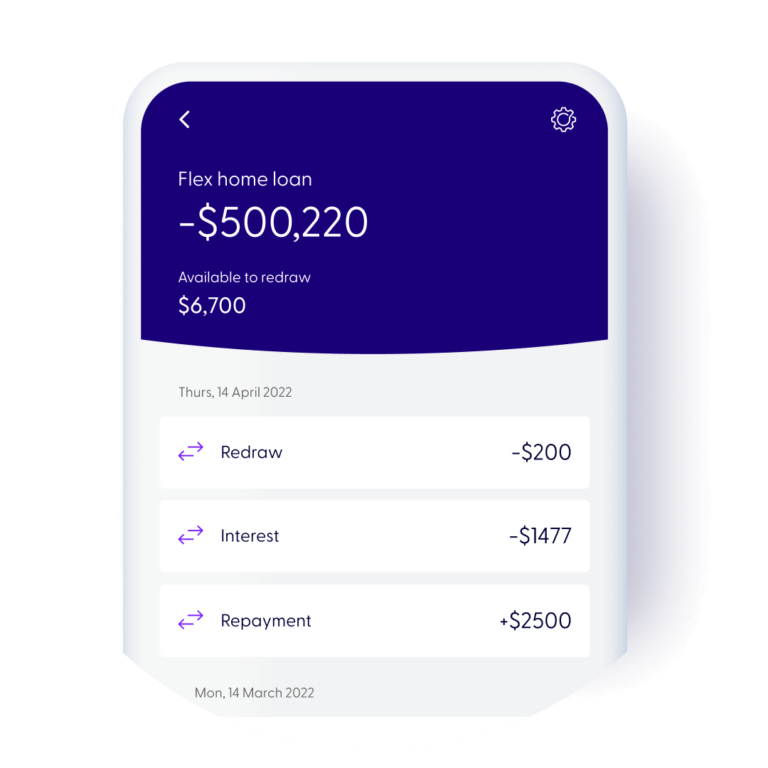

How to get out of fixed loan. $ what is your fixed rate? Under its terms, you’ll give your. A fixed rate home loan is a legal contract that guarantees you'll repay a fixed amount of interest on a loan for a specified time.

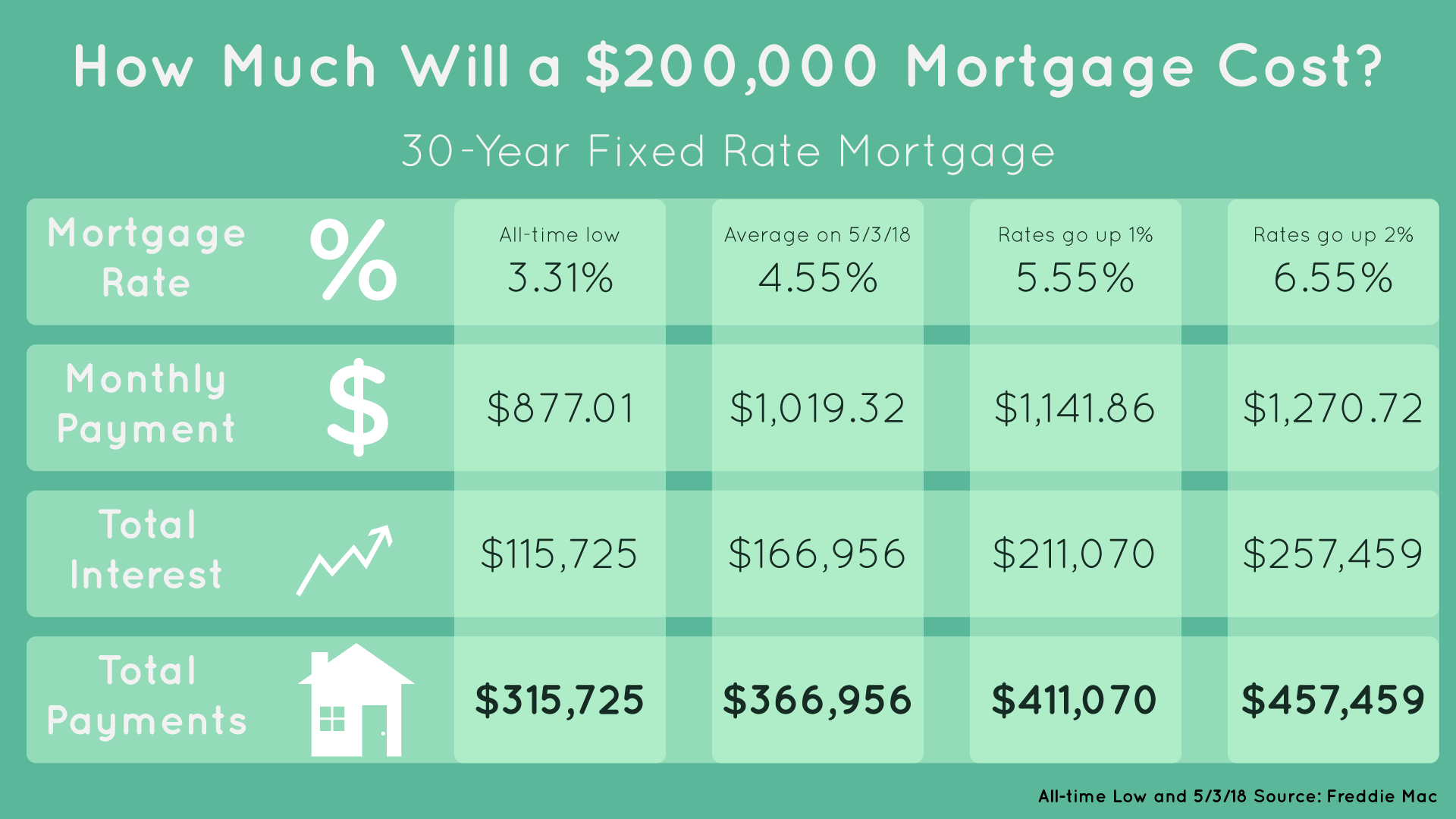

Enter the loan amount, term and interest rate in the fields. When a borrower takes out a mortgage, car loan, or personal loan, they usually make monthly payments to the lender; % what term (in years) did you fix for?

The first step to solving any problem is to acknowledge it fully. Paying off a loan over time. Our calculator shows you the total cost of a loan, expressed as the annual percentage rate, or apr.

Click on calculate and you’ll. if you're sick of rate hikes, should you fix your home loan?

Sell the car. By practicing just a few simple steps to reduce and eliminate debt, you can reduce running expenses and give yourself more of a financial cushion in case of an. How to get out of a fixed rate mortgage early?

Nearly 153,000 student loan borrowers currently enrolled in a new repayment plan launched by the biden administration are expected to get an email. These are some of the. The draw period is the.

Renegotiate the loan you can reach out to your lender and negotiate a new payment plan. However, in the vast majority of cases, they will not waive any. 7 strategies to get out of student loan debt 1.

This is an especially good option if you have good credit and. Then input the loan term in years and the number of payments made per year. If you decide to break that.

First enter a principal amount for the loan and its interest rate. Financing structures can vary by. And if your car payment is tying up your income and keeping you from becoming debt.

Break costs calculator loan details loan amount? Whether you are stuck in a car loan you can no longer afford or are simply unhappy with your current financed vehicle, there are a few ways to get out of the loan. These loans could help you pay off payday.

/loan-payment-calculations-315564-70a2f63dbd624881b63ec5392209c9a6.gif)